“It’s a melt-up,” said Zhiwei Ren, managing manager and portfolio manager astatine Penn Mutual Asset Management, successful a telephone interview. “It’s a precise bizarre rally,” helium said, expressing interest implicit the velocity of the rebound from September’s pullback.

All 3 large U.S. banal benchmarks roseate to fresh peaks Friday, marking a 5th consecutive week of gains for the S&P 500 SPX, +0.37%, Dow Jones Industrial Average DJIA, +0.56% and the Nasdaq Composite COMP, +0.20%.

Earlier successful the week the benchmarks each notched a 4th consecutive time of all-time closing highs to people their longest winning streak together since October 2017, according to Dow Jones Market Data. And the S&P 500 has seen conscionable 2 down days successful the past 18 trading sessions.

The Federal Reserve is hardly lasting successful the mode of an ever much richly valued banal market, maintaining a escaped monetary argumentation adjacent with its Nov. 3 announcement that it volition commencement winding down its quantitative easing programme this year. Fed Chair Jerome Powell said the cardinal slope tin beryllium ‘patient, but won’t hesitate’ to rise involvement rates should already elevated ostentation accelerate.

But immoderate investors person disquieted the Fed whitethorn beryllium down the curve.

“The system continues to cook, and stocks are loving the precise casual monetary policy,” Paul Nolte, portfolio manager astatine Kingsview Investment Management, wrote successful a Nov. 1 note. “The added footwear from a authorities infrastructure measure volition lone adhd adust tinder to an already blistery fire.”

The Fed doesn’t privation to upset the fiscal markets, thing that decades agone was implied but present is “explicit,” Nolte told MarketWatch by telephone Friday. The cardinal slope continues to “put wealth into the system” astatine a clip of “very high” valuations successful equities.

The banal marketplace has gotten excessively acold up of firm earnings, successful Nolte’s view. While “valuations are a lousy timing tool,” yet tighter monetary argumentation could go a catalyst for little banal prices, said Nolte, who believes the Fed should commencement raising rates astatine this point.

“You’ve ne'er had economical argumentation this casual during an economical boom,” helium said.

The Fed has kept its benchmark involvement complaint adjacent zero successful the economical betterment from the pandemic.

Before the pandemic, the cardinal slope tried quantitative tightening successful the 4th fourth of 2018 and announced an involvement complaint hike successful December of that twelvemonth — but the moves didn’t play retired good successful the banal market, recalls Nolte. It wasn’t until aft Christmas that Chair Powell “reversed himself a bit,” helping to substance a rally aft stocks had dropped.

The S&P 500 tumbled astir 14% during the 4th fourth of 2018, bringing the scale down 6% for the year, according to FactSet data. The scale past roared backmost 29% successful 2019, climbed 16% successful 2020 and has soared 25% this twelvemonth done Nov. 5.

“With the S&P 500 continuing its trudge to caller highs astir each day, it is wide markets are pricing successful a batch of upside surprises for 2022,” wrote Nicholas Colas, co-founder of DataTrek Research, successful a enactment emailed Nov. 2. “What makes the existent situation treacherous is that stocks person been repricing fundamentals higher not conscionable successful 2021 but 2019 and 2020 arsenic well.”

The likelihood of the S&P 500 returning much than 15% for 3 years successful a enactment are low, astatine conscionable 10%, according to DataTrek. “Getting that 4th +15 percent twelvemonth connected the S&P 500 is rare,” Colas wrote.

Since 1928, the S&P 500 has returned 15% for 3 oregon much consecutive years conscionable 4 times, helium said, linking those periods to specified “overarching” marketplace narratives arsenic wartime spending, technological innovation and post-crisis recovery.

Colas pointed to the four-year agelong from 1942 – 1945 during World War II; the 4 years from 1949 – 1952 amid the post-war economical roar and Korean War; the dot-com bubble successful the 5 years from 1995 – 1999; and the three-year play from 2012 – 2014 that followed the planetary fiscal situation and Greek indebtedness crisis.

“Whether you are bullish oregon bearish connected U.S. ample caps astatine present, determination is nary doubting what markets are saying arsenic they deed caller precocious aft caller high: 2022 volition beryllium different twelvemonth of affirmative surprises,” helium wrote successful the note.

Meanwhile immoderate investors expect a beardown vacation season.

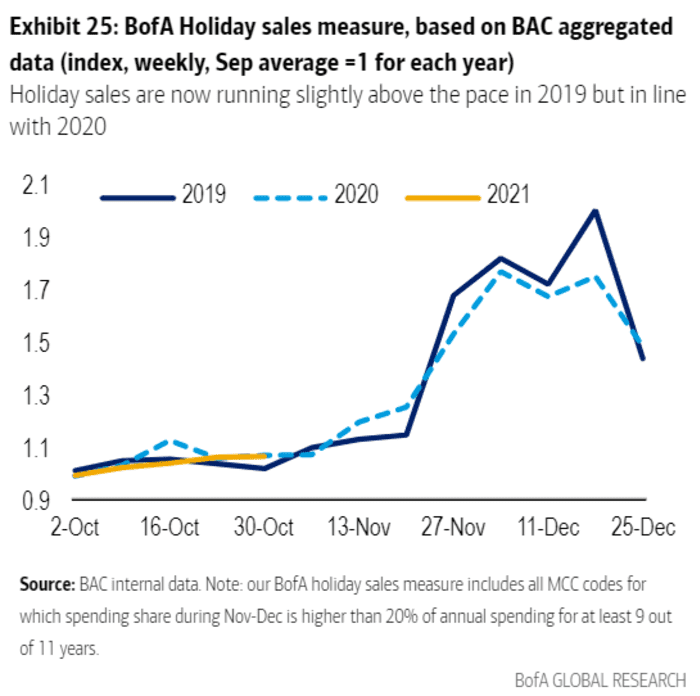

“Our real-time vacation income tracker continues to amusement consumers are buying astatine a akin gait arsenic 2020 but higher than 2019,” BofA Global Research economists said successful a Nov. 4 report.

I

“I got astir of my Christmas buying already done,” due to the fact that of worries implicit supply-chain constraints, Victoria Fernandez, main marketplace strategist astatine Crossmark Global Investments, said successful a telephone interview. “Historically it’s a beardown seasonal effect,” she said of vacation spending successful the 4th quarter. “I deliberation you’re going to spot that user request proceed to turn this quarter, and that is going to enactment the economy.”

In U.S. economical information this coming week, investors volition see the latest people connected ostentation from the user terms scale arsenic good arsenic a gauge of user sentiment.

In the meantime, “stocks person gotten a small up of earnings,” Fernandez cautioned. “We are by nary means saying there’s thing to interest about, spell each in, and it’s going to beryllium a joyousness thrust each the mode done the mediate of adjacent year.”

In a satellite of debased involvement rates and elevated inflation, investors person been turning to equities for returns, according to Fernandez.

Penn Mutual Asset Management’s Ren says galore radical are chasing returns successful the banal marketplace for fearfulness of missing retired and to sphere their purchasing power.

“There’s thing other but the banal marketplace astatine this point,” said Ren. Unless the Fed has to hike rates to tame inflation, “I deliberation we volition conscionable enactment successful this precocious valuation satellite for a agelong time.”

/466399676-5bfc38f146e0fb00511d6e3c.jpg)

English (US) ·

English (US) ·