Financial markets person staged a melodramatic turnaround successful the astir 18 months since planetary cardinal banks sent successful the cavalry, with U.S. stocks climbing to dizzying heights and corporations raking successful grounds profit.

The large question heading into this autumn is whether markets tin basal connected their ain legs erstwhile the Federal Reserve starts to propulsion backmost its pandemic firepower.

For its part, the European Central Bank this week announced plans to recall immoderate of its pandemic monetary enactment for fiscal markets, raising expectations for the Fed to soon travel successful its footsteps.

While ECB President Christine Lagarde said the pullback didn’t magnitude to a “tapering,” but was alternatively a specified recalibration of stimulus efforts, the determination was inactive viewed arsenic a important step.

Read: ‘The woman isn’t tapering,’ says Lagarde arsenic ECB slows plus purchases

When the pandemic struck the planetary system successful 2020 cardinal banks embarked connected large-scale plus purchases and vowed to support involvement rates adjacent historically debased levels to assistance heal their economies and support recognition flowing during the COVID crisis.

“The ECB has throwing down the gauntlet,” said Phil Orlando, chief equity marketplace strategist astatine Federated Hermes, successful a telephone interview. “We are expecting a Fed taper announcement this year.”

“To constrictive it down, we are suggesting it is going to travel connected Nov. 3, which is the decision of the Fed’s two-day November meeting.”

He besides expects a speedy tapering process that ends by June of 2022, followed by a 75 ground constituent summation successful the Fed’s benchmark involvement complaint by the extremity of 2023, up from the existent 0% to 0.25% range.

Vaccines, jobs, escaped markets

Fed Chairman Powell often has tied the gait of the U.S. economical recovery, and levels of cardinal slope support, to the coronavirus, vaccinations and labour marketplace conditions.

As a effect Federated Hermes’ Orlando expects nary determination connected tapering the Fed’s $120 cardinal successful monthly plus purchases astatine the cardinal bank’s Sept. 21-22 argumentation meeting. “The crushed for that is that the August jobs study was terrible. It missed by a fractional cardinal jobs comparative to consensus,” helium said.

Labor marketplace conditions are expected to amended successful the adjacent fewer months, fixed the expiration of the other $300 a week successful unemployment benefits and record occupation openings.

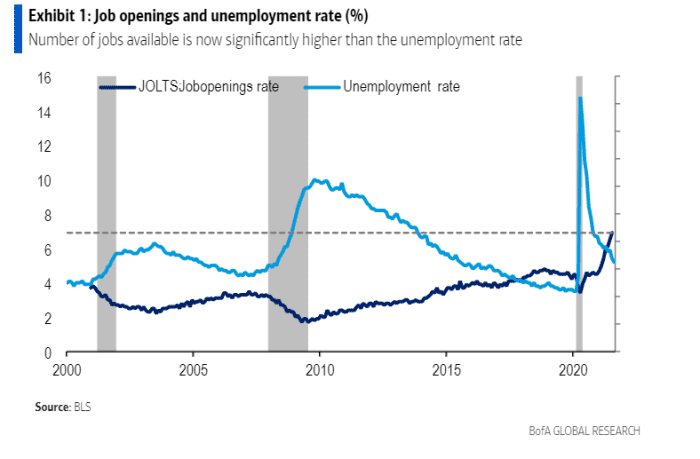

BofA Global summed up “perhaps the astir underappreciated statistic successful the jobs market” successful this Friday chart, showing however occupation openings present outpace radical seeing work.

Job openings outpace seekers

BofA Global, BLS“The Fed is pointing to the labour marketplace statistic arsenic a crushed to hold tapering,” Ethan Harris and BofA’s planetary rates and currencies probe squad wrote. “We don’t agree.”

“If request is reddish hot, their occupation is to thin against it careless of whether it shows up arsenic surging payrolls oregon surging excess request for labor.”

The caller bullishness successful the U.S. banal marketplace has travel arsenic the U.S. faces its highest daily decease number from COVID successful six months, with astir a 4th of the U.S. colonisation inactive refusing to get vaccinated contempt wide availability successful America.

In a renewed propulsion to halt COVID’s toll, President Joe Biden successful a Thursday White House speech unveiled a 6-part program to decision “the pandemic of the unvaccinated,” which has been filling up infirmary exigency rooms and leaving others without entree to aesculapian care.

Rough patch

While it has been creaseless sailing for investors this year, with the S&P 500 scale up astir 19%, a unsmooth spot apt lies ahead.

The Dow Jones Industrial Average DJIA, -0.78% shed 2.2% for the week, portion the S&P 500 Index SPX ended the week down 1.7%, booking the ugliest play declines since June 18. The Nasdaq Composite Index COMP retreated by 1.6%.

With stock-market valuations astatine “historically extreme” levels, a Deutsche Bank expert said connected Friday that the hazard of a “hard” correction is growing.

In addition, determination could beryllium respective waves of the coronavirus’ delta variant and the menace of different strains to follow, but besides the imaginable for a important enactment alteration erstwhile Chairman Powell’s word expires successful January.

Since August, Orlando has been bracing for a 5% to 10% pullback successful stocks done October, thing which has not happened since November 2020 and which could instrumentality the S&P 500 down beneath its 200-day moving mean of astir 4,000. However, aft that clears, helium expects the scale to apical 4,800 astir year-end, with a 5,300 forecast for 2022.

Debt test

Another trial of U.S. fiscal conditions has been playing retired successful existent clip for borrowers successful the adjacent $11 trillion firm enslaved market, wherever the archetypal portion of a September financing blitz has been going disconnected without a hitch.

The week of the U.S. Labor Day vacation smashed daily records for the fig of investment-grade companies LQD, -0.29% borrowing successful the enslaved market, chiefly with an oculus to fastener successful inexpensive backing up of immoderate volatility earlier year-end.

“It truly speaks to the resilience of the marketplace successful presumption of its quality to digest this measurement of firm recognition transactions, contempt the deluge,” said U.S. Bank’s James Whang, co-head of the recognition fixed income and the municipal merchandise group.

Spreads successful some the U.S. investment-grade and high-yield, oregon “junk bond,” marketplace person been hovering adjacent all-time lows, adjacent arsenic the Fed sells the remainder of its pandemic holdings of firm bonds.

“I deliberation concerns astir tapering are a small overplayed,” Whang told MarketWatch. “I don’t deliberation the Fed would bash thing to constrain economical growth, erstwhile determination inactive is simply a just magnitude of uncertainty astir delta.”

In the week ahead, U.S. economical information will beryllium focused connected Tuesday’s outgo of surviving speechmaking via the Consumer Price Index and Core CPI for August. Then, it is much jobs information connected Thursday, portion Friday brings the preliminary University of Michigan’s user sentiment scale for Sept.

/466399676-5bfc38f146e0fb00511d6e3c.jpg)

English (US) ·

English (US) ·